Why real estate investors should pay attention to Africa currency shifts

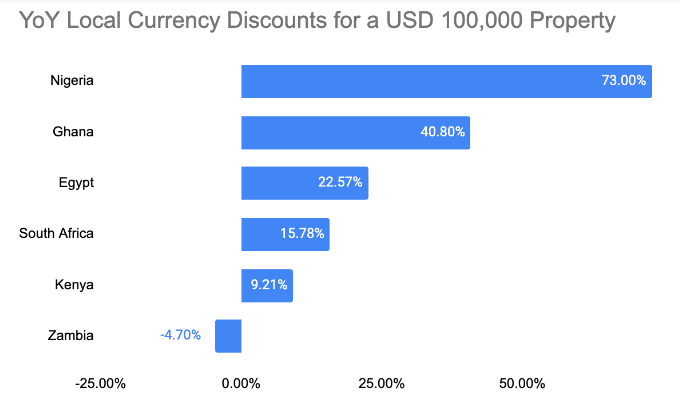

Source: Analysis data was derived from individual countries' Central Bank Rates

Similar Topics

The Lagos State Government has commenced the demolition of illegal structures within the Lekki Free...

a month ago Read MoreNigeria’s recently enacted Tax Act of 2025 (NTA 2025), which becomes effective on January 1,...

a month ago Read MoreMember States of the United Nations Human Settlements Programme (UN-Habitat) have endorsed a new...

2 months ago Read MoreNigeria Enters a New Tax Era Come January 2026, Nigeria’s property market will experience a...

3 months ago Read MoreImproved Security and Diaspora Capital Drive Rebound The housing sector in Nigeria’s...

3 months ago Read MoreThe Lagos State Government has announced that night-time repair works will take place on Ozumba...

4 months ago Read MoreThe Federal Government has suspended all previously approved, pending, and prospective applications...

5 months ago Read MoreThe Federal Government has successfully mobilised more than N70 billion in private capital...

5 months ago Read MoreThe Lagos State Government, through the Lagos State Physical Planning Permit Authority (LASPPPA),...

7 months ago Read MoreThe Federal Government has expanded the Abuja-Kaduna-Kano Road project to incorporate a direct...

7 months ago Read MoreThe Federal Capital Territory Administration (FCTA) has taken possession of Wadata Plaza, the...

8 months ago Read MoreDefaulters on FCT ground rent now have 14 days grace to pay up what they owe the FCT Administration...

8 months ago Read MoreUnprofessional practices by estate agents in major cities are significantly influencing the spike...

8 months ago Read MoreA Real estate development firm, Lifecard International Investment Company, has revealed that many...

9 months ago Read MoreDespite a fall in investment volumes from the 2021 peak, there is an ongoing desire for property...

9 months ago Read MoreThe Lagos State government has advised the leadership of the Nigerian Institution of Estate...

9 months ago Read MoreReal estate market dynamics such as construction cost, land, finance, government policies and taxes...

9 months ago Read MoreEvent Set to Celebrate Managers Who Shape Careers and Drive Organizational Growth Business...

10 months ago Read MoreGlobal Leaders to Converge in Lagos for Landmark Event Driving Urban Innovation and...

10 months ago Read MoreIn a bold move to redefine affordable luxury housing, Nigerian real estate giant Gtext Holdings has...

10 months ago Read More